What is the Savings Rate?

The savings rate is the percentage of income that remains after all consumption expenditures. For instance, if someone saves 20% of their monthly income, their savings rate is 20%. This metric is important for understanding financial health at both individual and national levels.

Savings Rates in the United States

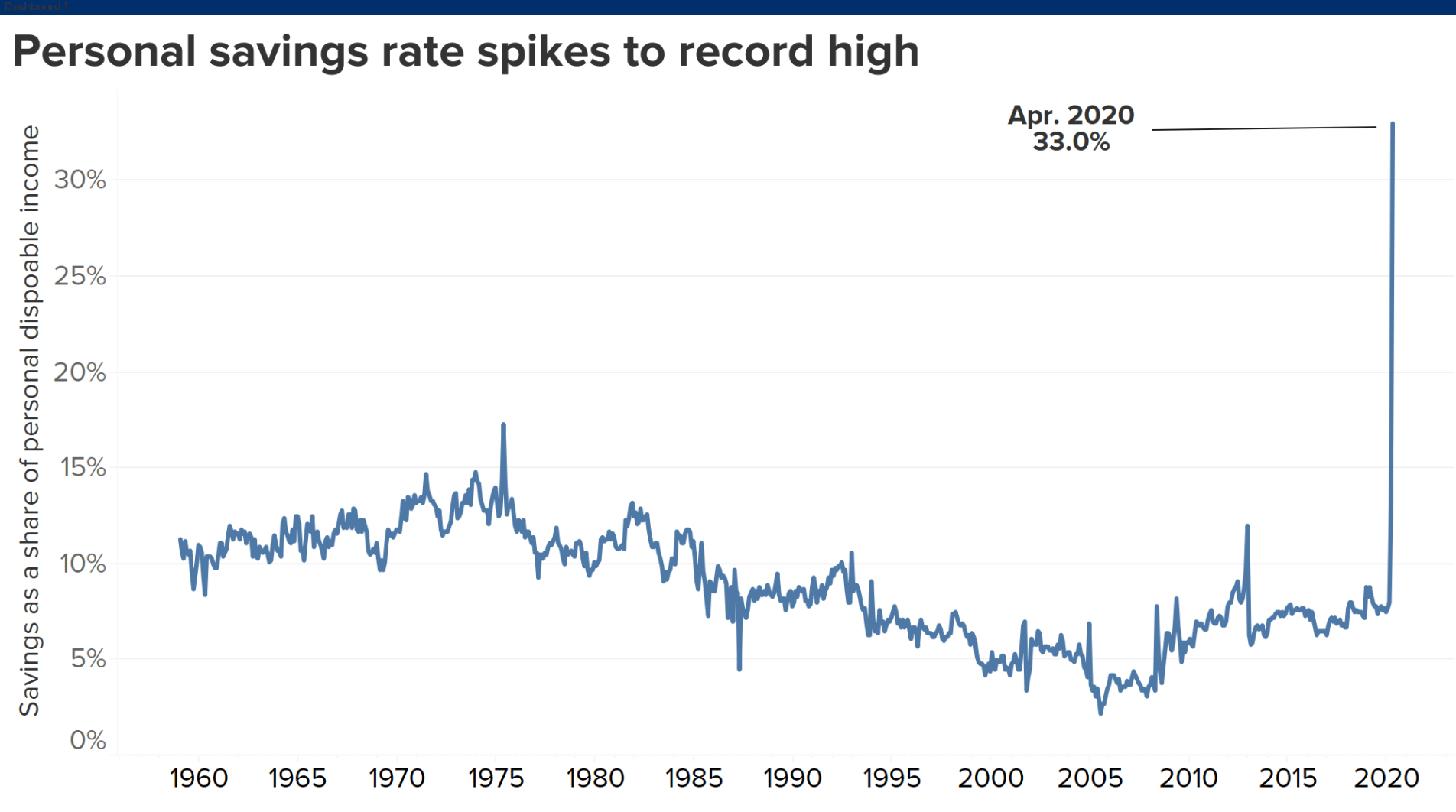

In the U.S., savings rates have fluctuated over the years, often influenced by economic conditions, interest rates, and government policies. For example, during periods of economic uncertainty, such as the 2008 financial crisis or the COVID-19 pandemic, household savings rates tend to increase as consumers cut back on spending and increase their savings.

Current Trends:

The U.S. personal savings rate has seen significant changes, especially during the pandemic. In April 2020, the savings rate peaked at 33.8%, the highest recorded level since the U.S. Bureau of Economic Analysis (BEA) began tracking the data. However, post-pandemic, savings rates have normalized, typically ranging between 5% and 10%.Challenges:

Despite these fluctuations, long-term savings rates in the U.S. are relatively low compared to other developed nations. Many Americans face difficulties saving due to high living costs, stagnant wages, and rising debt levels. In 2023, the U.S. savings rate hovered around 4.8%, indicating that many households struggle to save a substantial portion of their income.

Savings Rates in the United Kingdom

The U.K. also experiences variations in savings rates, often reflecting broader economic shifts. British households, like their American counterparts, adjust their savings behavior based on economic conditions, interest rates, and government measures.

Current Trends:

The U.K. savings rate has generally been lower than many other European countries but saw an increase during the COVID-19 pandemic. In the second quarter of 2020, the savings rate reached a record high of 27.4%, as many consumers held back on spending due to lockdowns and economic uncertainty.Post-Pandemic Adjustments:

After the pandemic, savings rates in the U.K. have returned to more typical levels. In 2023, the U.K.’s savings rate was around 6.8%, still lower than in many European countries but indicative of a gradual return to pre-pandemic behavior.

Comparison of U.S. and U.K. Savings Rates

While both the U.S. and U.K. experienced spikes in savings rates during the COVID-19 pandemic, their long-term savings behaviors differ. The U.S. tends to have a lower average savings rate compared to many other developed nations, including the U.K., which is slightly higher but still falls behind many European counterparts like Germany or Switzerland.

International Perspective

Globally, savings rates vary widely. Countries in Europe, particularly Germany and Switzerland, tend to have higher savings rates, often exceeding 10-15%. In contrast, nations like the U.S. and U.K. typically have lower savings rates, which can impact both national economic stability and personal financial resilience.

Factors Influencing Savings Rates

Economic Conditions:

Recessions or financial crises often push consumers to save more due to uncertainty.Government Policies:

Interest rates set by central banks influence savings. Higher interest rates often encourage more savings, while lower rates promote spending.Cost of Living:

High living costs, especially in cities, can limit individuals’ ability to save.

Conclusion

Savings rates in both the U.S. and U.K. play an essential role in shaping their economies. While both countries experienced temporary increases in savings during the pandemic, the long-term trend shows that households in these nations tend to save less than their European counterparts. Understanding these trends is vital for policymakers looking to foster financial stability and economic growth.

This article is for informational purposes only and does not constitute professional advice.

Hiç yorum yok: